restaurant food tax in maryland

Sale of beer wine. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6.

2022 Best Thanksgiving Restaurants Maryland Suburbs Dc Gayot

Depending on the type of business where youre doing business and other specific regulations.

. Eleven of the states that exempt groceries from their sales tax base include both candy and. Depending on the type of business where youre doing. How is food taxed.

The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. What This Means for RestaurantsOn July 1 2011 the tax on the sale of alcoholic beverages increases from 6 to 9. By statute the 6 sales and use tax is imposed on a bracketed basis.

In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off. In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by a. Twenty-three states and DC.

You can read Maines guide to sales tax on prepared food here. Restaurant Food Tax In Maryland. Maryland Food for.

A Montgomery County Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency. A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency.

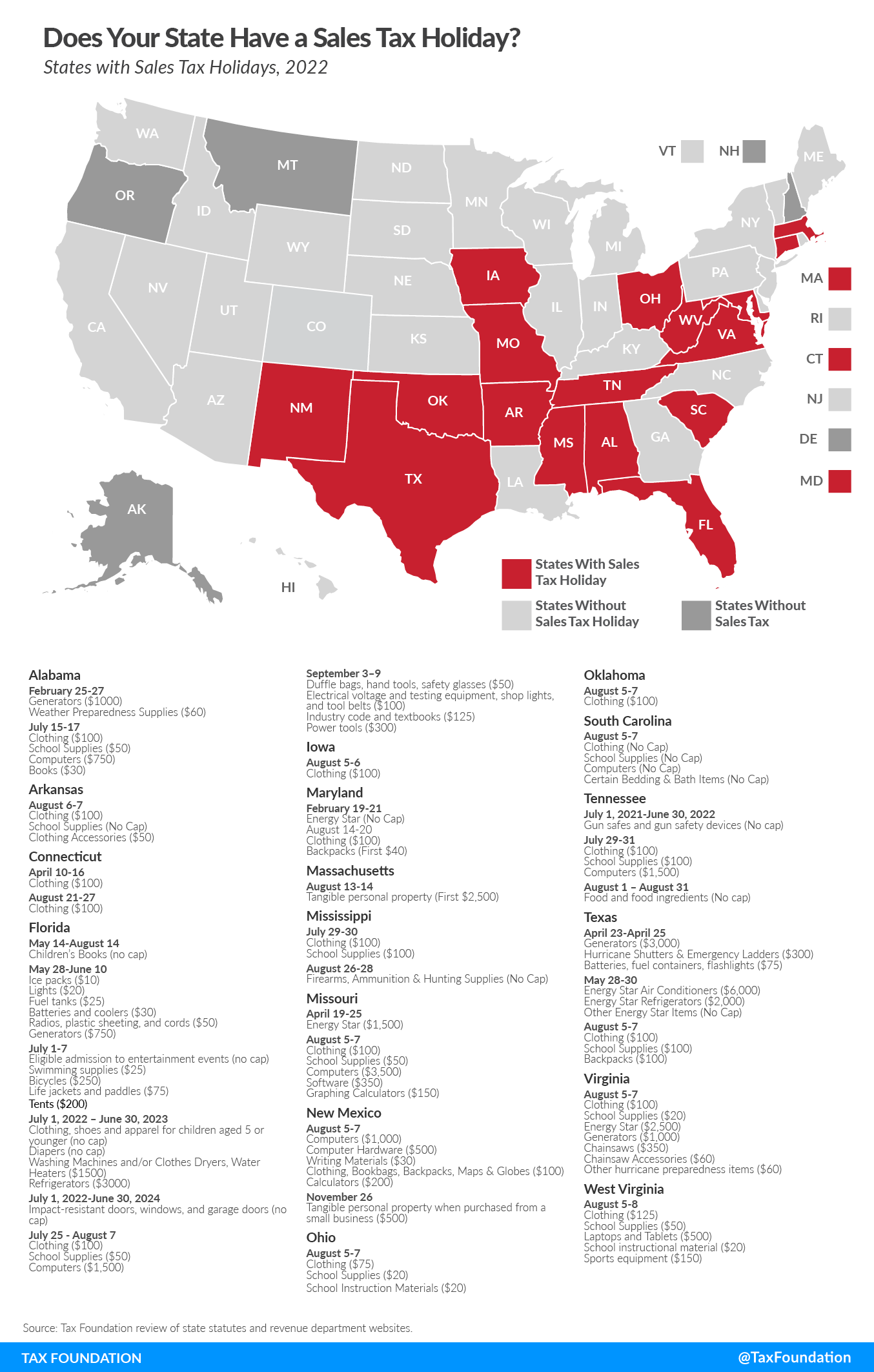

While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 2022 Maryland state sales tax. Maryland Sales and Use Tax Increases to 9.

Treat either candy or soda differently than groceries. 600 Is this data incorrect The Annapolis Maryland sales tax is 600 the same as the Maryland state sales tax. How are Sales of Food Taxed in Maryland.

The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets. All sales of food and beverage are subject to the tax except the following cases. Exact tax amount may vary for different items.

Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8. In the state of maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Depending on the type of business where youre doing business and other specific.

In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream. This page describes the taxability of. 2022 Maryland state sales tax.

While many other states allow counties and other localities to collect. Purchase breakfast lunch or dinner from participating restaurants by using your EBT card.

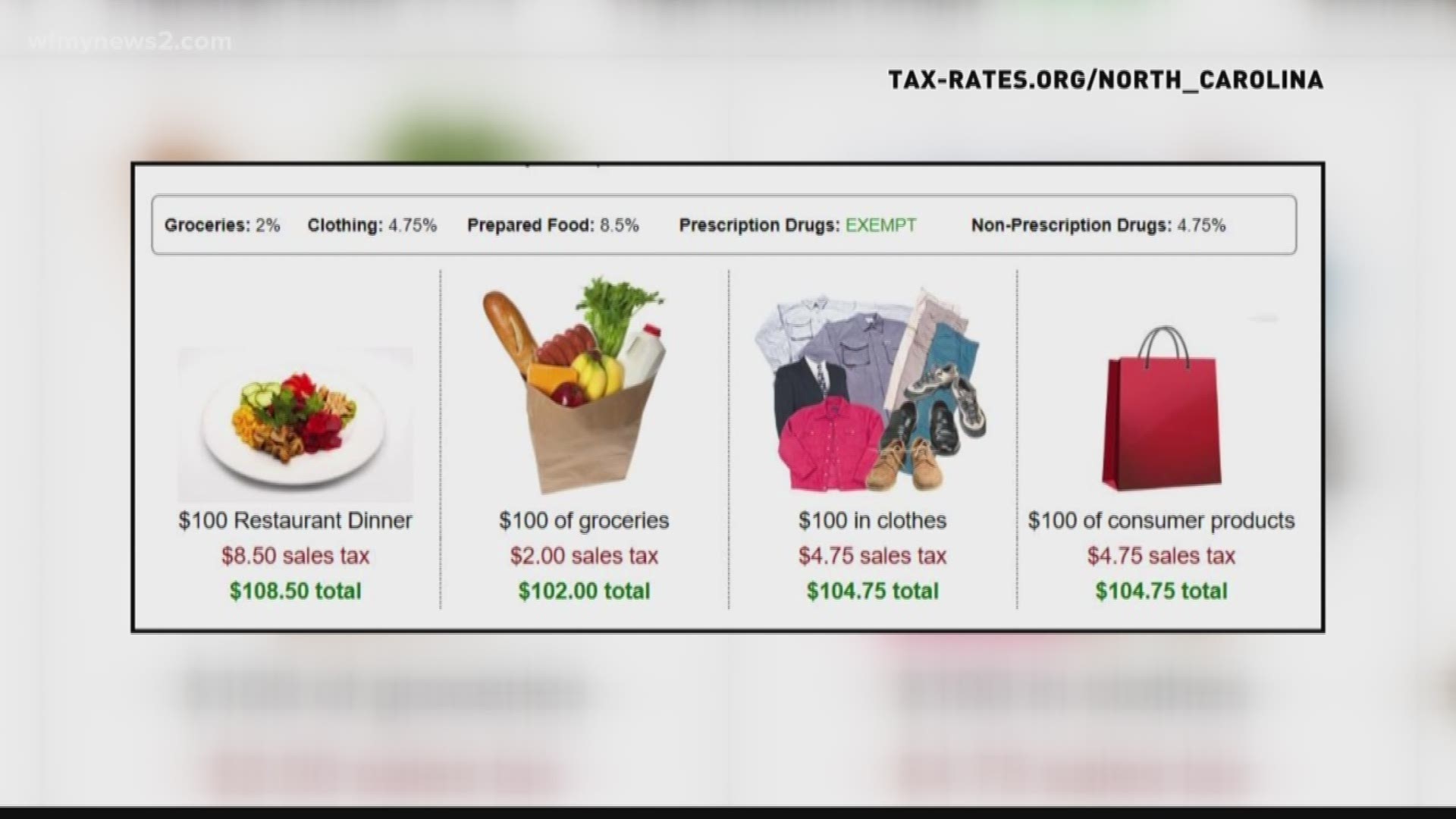

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Best Local Restaurants In Landover Hills Maryland Oct 2022 Restaurantji

/cdn.vox-cdn.com/uploads/chorus_image/image/71028467/US_Fried_Chicken_Chain_Bracket_Lead.0.png)

Best Fast Food Fried Chicken In America The Bracket Eater

Restaurant Sales Gain Ground In March As Consumers Tax Refunds Roll In

Pizza Beer Family Friendly 120 Item Menu Hagerstown Md 21740 Locations Bj S Restaurants And Brewhouse

Exemptions From The Maryland Sales Tax

Taxes On Food And Groceries Community Tax

Online Menu Of Oishi Sushi Hibachi Restaurant Hagerstown Maryland 21740 Zmenu

Tradewinds Restaurant Menu In Baltimore Maryland Usa

Is The Food I Sell On My Food Truck Taxable Taxjar

Dinner Menu Carousel Oceanfront Hotel Ocean City Md

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Schmankerl Stube Bavarian Restaurant Hagerstown Md

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities